There is more than 50 million sq. ft. of medical office development currently in the construction pipeline throughout the United States. America’s aging population continues to drive demand for medical

The Asset Classes Poised To Thrive As CRE Enters Recession ‘Danger Zone’: Moody’s

Income drivers for U.S. commercial and residential real estate were as strong as predicted in the first quarter of 2022, with multifamily and industrial doing particularly well — but the

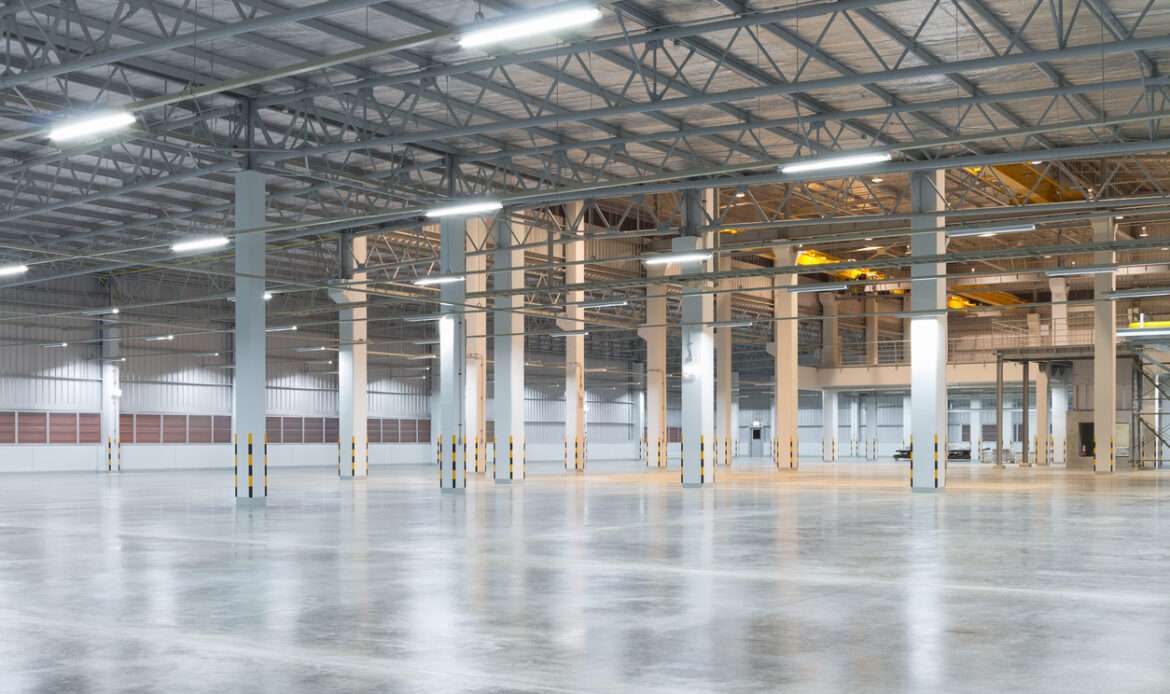

Investors, End-Users Compete for Last-Mile Warehouses as Rents Skyrocket

Investors, End-Users Compete for Last-Mile Warehouses as Rents Skyrocket Rents for these facilities can often be 50 percent above those at distribution facilities in traditional locations. Last-mile facilities, which were

Investors Stick With CRE Despite Market Uncertainty

CRE investors are looking past the headlines and they’re looking at the hard facts. Investors are “sticking with” commercial real estate despite persisting geopolitical uncertainties and inflationary pressures, according to

The Industrial Sector’s Scorching Run Continues

The Industrial Sector’s Scorching Run Continues Exclusive research shows high levels of bullishness for industrial real estate, although capital markets have begun to tighten. Concerns about inflation, rising interest rates

Multi-Story Warehouses Are Still a Rarity in the U.S. But That Is Changing

Multi-story construction is now economically justified in many markets due to skyrocketing land prices for industrial development. While multi-story warehouses are still rare in the U.S., they represent a