By assuming existing loans, investors can mitigate the risk from rising interest rates and ultimately underwrite a greater leveraged return, market participants say. The short-term borrowing rate is at its

‘Rapid Repricing’: Higher Interest Rates Slow CRE Deals, But Many Investors Won’t Be Deterred

Real estate debt investors have been enjoying favorable economic conditions for the last few years. Despite the pandemic-fueled economic upheaval, money has been cheap and lately, conditions have been looking up

The Medical Office Sector Continues to Hold Steady

Demand remains high and the tenant base is stable, leading to healthy interest from real estate investors. The medical office sector couldn’t be in better shape despite fears of the

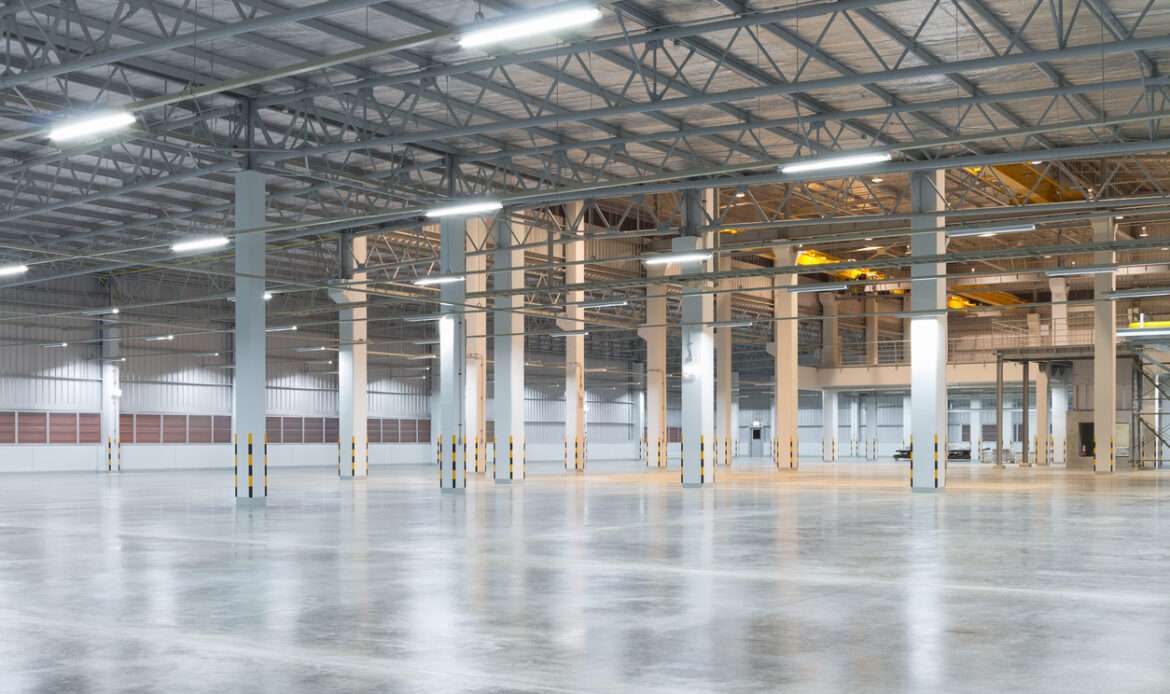

Investors, End-Users Compete for Last-Mile Warehouses as Rents Skyrocket

Investors, End-Users Compete for Last-Mile Warehouses as Rents Skyrocket Rents for these facilities can often be 50 percent above those at distribution facilities in traditional locations. Last-mile facilities, which were

Investors Stick With CRE Despite Market Uncertainty

CRE investors are looking past the headlines and they’re looking at the hard facts. Investors are “sticking with” commercial real estate despite persisting geopolitical uncertainties and inflationary pressures, according to

The Industrial Sector’s Scorching Run Continues

The Industrial Sector’s Scorching Run Continues Exclusive research shows high levels of bullishness for industrial real estate, although capital markets have begun to tighten. Concerns about inflation, rising interest rates