Summary

The onset of the coronavirus pandemic has had a significant operational impact on Fort Lauderdale’s office market. Construction has slowed down, and the vast majority of companies have transitioned their employees to work from home. The majority of the county’s office employment sector is operational remotely, while those that must work with public offices and the court system are at a standstill, as public offices will remain closed in the foreseeable future.

It is too early to evaluate the impact on office employment, as both the State as well as the Federal government have put in place measures to support businesses in the area. Fort Lauderdale office employment growth registered at close to 2% over the year before the ones of the coronavirus pandemic. The metro saw the most robust office employment growth among South Florida’s counties, but office employment was one percent below that of the prior year. Office employment is likely to register a decline over the next year. Any weakness in office employment growth could impact demand for space as well as rent growth. The majority of Fort Lauderdale’s companies are comprised of small and medium-sized businesses, and many have less than ten employees. Depending on the fiscal response, many small companies may be adversely impacted, causing the office unemployment rate to rise.

Vacancy rates remained below the national average, plateauing at close to 9% over the year before the onset of the pandemic. Depending on the severity of the economic fallout, vacancies could rise by two percent over the next year. Several large high-end office buildings are nearing completion, a fact that will add upward pressure on the metro’s vacancy rate.

Leasing

Like the national market, Fort Lauderdale was at an advanced stage in the economic cycle before the coronavirus crisis onset. Vacancies had plateaued at close to 9%, as the market saw minimal new deliveries and absorption turned negative for several quarters. While the new supply was limited over the past five years, construction has picked up. Several large projects are in the works and are set to increase inventory by close to 3%, about a percent above the national average.

The upcoming supply wave puts further upward pressure on the vacancy rate. The demand outlook remains uncertain as the full impact from the coronavirus pandemic onset is unknown at this point. Depending on the severity of the economic fallout, vacancies could rise by a further 2% over the next year.

Rent

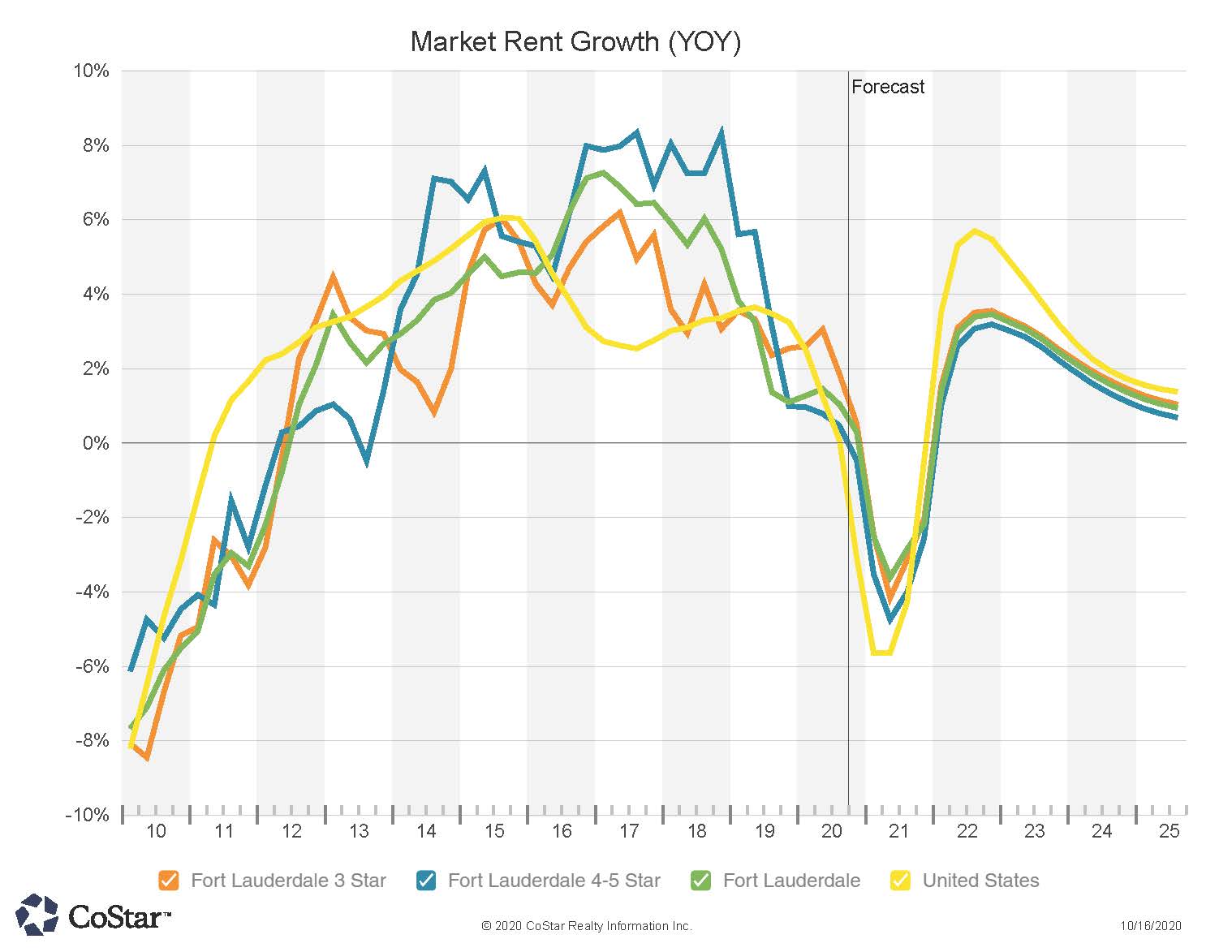

The demand outlook remains uncertain, as the full impact from the coronavirus pandemic is unknown at this point. A weakening economic outlook will likely translate to significantly lower rent growth over the next few quarters. Rent growth across the Broward office market was on the decline and below the national average for several quarters prior to the onset of the coronavirus pandemic. While decelerating rent growth is a national trend, the rising supply and several quarters of negative absorption put Fort Lauderdale’s rent growth in a weaker standing.

Areas with higher construction, especially in the metro’s urban core, are likely to see the largest rent declines by the end of the year. Suburban office markets did quite well over the past five years and managed to attract several large tenants as well as most of the metro’s large construction. While Fort Lauderdale’s suburbs were the largest demand beneficiaries, they will not be immune to the fallout from the onset of the coronavirus pandemic.

Sales

Transaction volume for the year before the onset of the coronavirus pandemic was substantial and comparable to the prior year. As with the rest of the country, the coronavirus pandemic has disrupted the financing and added uncertainty when pricing transactions that are currently in the pipeline. Lending spreads have recently widened significantly, something that could cause many deals that are now in the works to get canceled or renegotiated.

Before the onset of the pandemic, most buyers were seeking opportunities in Fort Lauderdale’s suburbs. Growing suburban submarkets, like Sawgrass Park, Southwest Broward, and Cypress Creek, accounted for half of the year’s activity, with several $10 million to $50 million transactions. The metro’s urban core, Downtown Fort Lauderdale, accounted for another 20% of the volume.

Just over 60% of buyers and sellers are private investors, and they were net sellers over the past year. Private equity investors account for close to a fifth of the activity, and they were also net sellers. Institutional investors, the third most significant investor category, were net buyers, and they also account for close a fifth of the prior year’s activity. REITs are present in the metro, but their activity is minimal, and they account for less than 5% of the metro’s deal volume.

Close to three-quarters of buyers are national. Local investors accounted for close to a third of the activity and were net buyers. International investors accounted for close to 10% of the deal volume, and they were net sellers.

Prices rose by close to 40% over the past five years. Valuations rose on the back of strong rent growth, as well as by the limited supply. However, supply is on the rise, and uncertainty is extremely high, given the onset of the coronavirus pandemic.

The loss of economic confidence could lead to rising vacancy rates and declining rents over the medium term. As cash flows become less certain, valuations will become inherently riskier and, together with more expensive financing, will likely lead to a significant reduction in investment activity over the next couple of quarters as investors sit on the sidelines while the dust settles.

Economy

Though Fort Lauderdale has regained a portion of the jobs lost in the early months of the coronavirus pandemic, Broward County continues to feel the impact of lockdowns and a high caseload. As of the Bureau of Labor Statistics’ (BLS) release of August jobs figures, the metro was still down more than 80,000 jobs since February.

In March and April when the economy went into lockdown, Fort Lauderdale lost more than 130,000 jobs. Florida started to gradually re-open establishments in mid-May which led to a recovery of about 27,000 jobs in Broward County that month. The recovery continued, at a much slower rate, in the months which followed. In June, about 19,000 more jobs came back, but by July, as the city continued to contend with the spread of the virus, distancing mandates and limits on indoor gatherings were again implemented and jobs were again lost. By August, the county had recovered about 47,000 jobs, just 36% of the 130,000 jobs originally lost.

The virus continues to impact tourism, an industry which is important to Fort Lauderdale’s economy. Jobs in leisure and hospitality, which comprised more than 11% of the county’s workforce pre-pandemic, remained down about 30,000 jobs as of August. This represents a recovery of about 44% of the 53,000 jobs the sector lost in March and April.

Retail trade jobs have also been hit hard while shops have closed, and many people choose to stay home even after mandates have been lifted. About 113,000 people worked in retail trade in Fort Lauderdale pre-pandemic. As of the BLS’ August report, more than 8,000 such jobs had been recovered since the state re-opened in mid-May but the sector was still down more than 5,000 jobs from February.

The greater trade employment sector, excluding retail trade, has struggled as well. In addition to the nearly 14,000 retail trade jobs lost in March and April, the market lost an additional 7,000 non-retail trade, transportation, and utilities jobs. By August, the sector was still down more than 5,000 jobs, having recovered less than 30% of losses.

Since South Florida implemented some of the longest lockdowns due to the heightened spread of the virus, the economic recovery here is likely to be slow. Broward County does benefit, however, from a diverse workforce where no one industry accounts for more than 20% of jobs. This should help to insulate Fort Lauderdale from higher losses as a proportion of the workforce during downturns.