Summary

The onset of the coronavirus pandemic has had a significant impact on Fort Lauderdale’s retail sector. The metro registers a construction pipeline that is double the national average, relative to inventory. Construction activity has likely slowed as material delays can occur due to the supply chain disruption. Social isolation measures put in place to slow the spread of the coronavirus have resulted in metro-wide store closures and radical cuts in discretionary spending.

The retail sector, including leisure and hospitality, saw the most immediate and the most substantial impact from the onset of the pandemic. These two sectors are also expected to see the highest job losses over the second quarter of the year. Grocery stores, pharmacies, gas stations, and banks remain open. Most grocery stores have scaled back hours to between 8 a.m. and 8 p.m. but have seen a sharp increase in business activity and are ramping up hiring. The grocery store supply chain remains unaffected by the pandemic, and while some items appear to be out of stock, that is mostly due to panicked shoppers stocking up.

Fort Lauderdale is South Florida’s second-largest retail market, with a stock of 109 million SF. The metro’s retail sector performed well over the five years before the onset of the coronavirus pandemic. Vacancies will rise over the next couple of quarters. The metro’s major retail drivers include the local economy, favorable demographics, and a large number of visitors that vacation in the area every year. The cuts in discretionary spending across the country will lead to a reduction in visitors, something that exposes Fort Lauderdale, together with Miami, to a higher economic decline risk.

Leasing

The demand outlook remains uncertain, as the full impact from the coronavirus pandemic is still unfolding. According to Oxford Economics, the U.S. economy is in a recession. The coronavirus pandemic will lead to profound, pervasive, and persistent, but not permanent activity reduction, with widespread cuts in discretionary and social spending, severe disruptions to supply chains, and a significant interruption in travel activity. Factoring in the ongoing financial market stress and depressed oil prices, Oxford Economics expects real U.S. GDP to contract by 0.2% in 2020, down from 1.7% growth pre-virus.

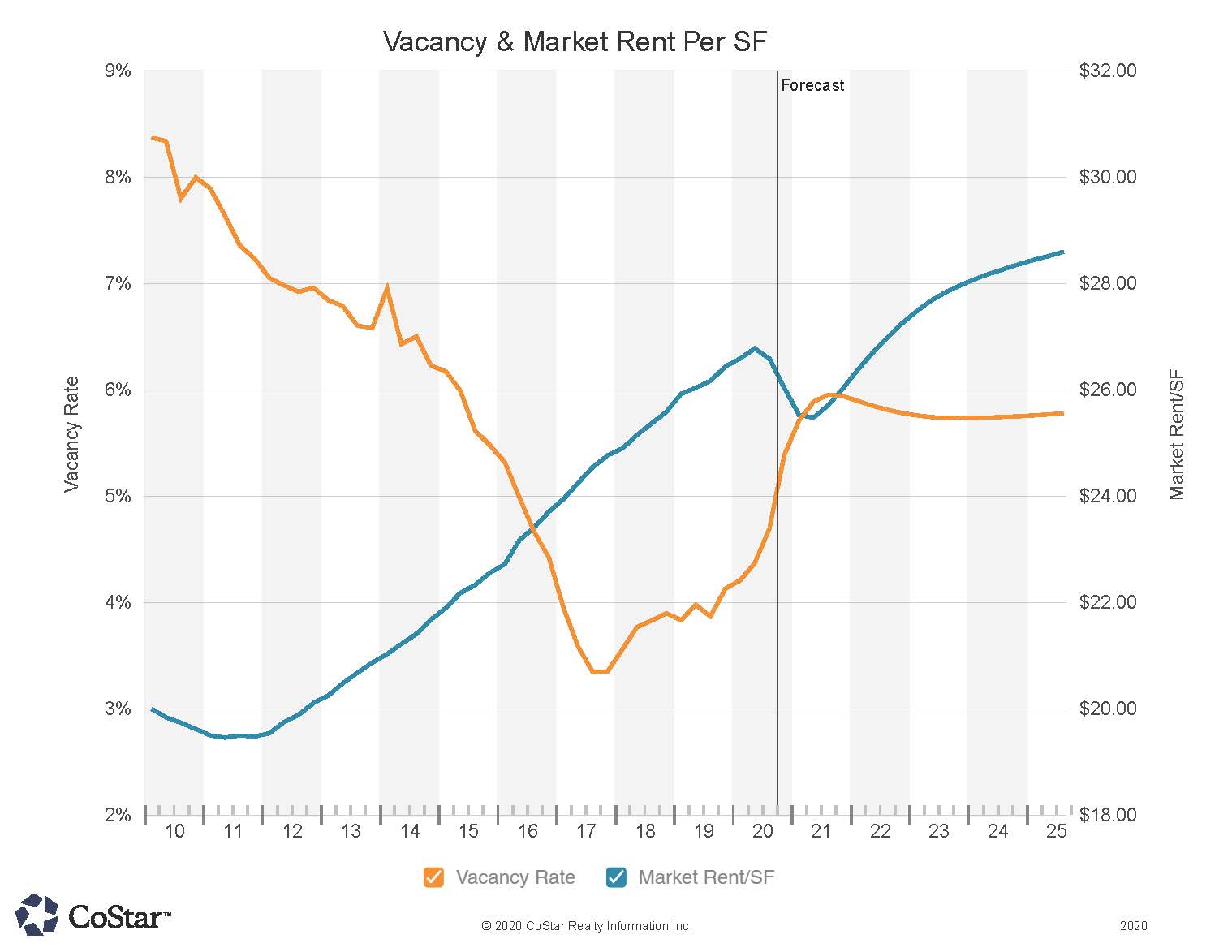

Measures to slow down the spread of the coronavirus have included a severe reduction in travel and hotel closures, something that is having a significant impact on the Fort Lauderdale retail market. Visitors drive a substantial part of the metro’s retail spending. Prior to the onset of the coronavirus pandemic, on the back of elevated deliveries over the past couple of years, vacancies had trended upwards from the cycle lows seen at the end of 2017.

A weakening economic outlook could translate to the vacancy rate spiking over the next couple of quarters. Many of the area’s retail businesses are small and medium-sized and are more vulnerable given the weakening demand over the medium term. The coronavirus pandemic found the metro’s retail sector in good shape and with a vacancy rate below that of the national average. Over the past five years, the metro’s household income growth exceeded the national average. The federal government has put in place several support measures that will limit the damage from the economic fallout for small and medium-sized businesses.

A weakening economic outlook and lower visitor traffic, in conjunction with the high level of construction, will likely translate to a vacancy rate spike.

Rent

Rent growth has been the large casualty of the national retail sector transformation, and rents have consistently declined across the country over the past couple of years. Rental rates are at $26.00/SF and are higher than the national average. The Downtown Fort Lauderdale and Southwest Broward submarkets register rents that are close to $35/SF. These are areas that have seen significant multifamily and retail development over this cycle.

The sector has moved from a growth to a preservation mode over the past few weeks. Owners are more concerned about collecting rents due at the end of each month, rather than increasing rents. The weakening economic outlook from the onset of the coronavirus pandemic, together with the metro’s relatively high construction pipeline, are likely to translate to declining rents in many parts of the metro over the next several quarters.

Sales

The current uncertain environment suggests that transaction activity is likely to slow as uncertainty weighs more heavily on investors and lenders. Investors will need to reassess their projections for future cash flows and property performance, as the coronavirus-spawned recession renders their projections increasingly uncertain. Lenders are also more reluctant to lend as the recession progresses, instead, pausing to evaluate rent growth assumptions and deal profiles. Meaningful declines in the deal volume are expected as a result, but first-quarter investment volume registered at a level comparable to that of comparable quarters in prior years

At $637 million, investment activity for the year before the onset of the coronavirus was close to 30% off the 2015 cycle highs. Retail space in this market trades for an average of $260/SF, which carries a 20% premium over the national average. Downtown Fort Lauderdale and surrounding areas remained a popular target for investors, mainly because of the developing live/work/play atmosphere and the high-end shopping along Las Olas Boulevard. Prices have appreciated by close to 20% over the past five years.

Price growth decelerated over the year before the onset of the coronavirus pandemic. Buyers became much more opportunistic, targeting shopping centers in suburban parts of the metro.

As with the rest of the country, the coronavirus pandemic has disrupted the financing and added uncertainty when pricing transactions that are currently in the pipeline. Lending spreads have recently widened significantly, something that could cause many deals that are now in the works to get canceled or renegotiated. As cash flows become less certain, valuations will become inherently riskier, and together with more expensive financing, will likely lead to a significant reduction in investment activity over the next few quarters as investors sit on the sidelines while the dust settles.

Economy

Though Fort Lauderdale has regained a portion of the jobs lost in the early months of the coronavirus pandemic, Broward County continues to feel the impact of lockdowns and a high caseload. As of the Bureau of Labor Statistics’ (BLS) release of August jobs figures, the metro was still down more than 80,000 jobs since February.

In March and April when the economy went into lockdown, Fort Lauderdale lost more than 130,000 jobs. Florida started to gradually re-open establishments in mid-May which led to a recovery of about 27,000 jobs in Broward County that month. The recovery continued, at a much slower rate, in the months which followed. In June, about 19,000 more jobs came back, but by July, as the city continued to contend with the spread of the virus, distancing mandates and limits on indoor gatherings were again implemented and jobs were again lost. By August, the county had recovered about 47,000 jobs, just 36% of the 130,000 jobs originally lost.

The virus continues to impact tourism, an industry which is important to Fort Lauderdale’s economy. Jobs in leisure and hospitality, which comprised more than 11% of the county’s workforce pre-pandemic, remained down about 30,000 jobs as of August. This represents a recovery of about 44% of the 53,000 jobs the sector lost in March and April.

Retail trade jobs have also been hit hard while shops have closed, and many people choose to stay home even after mandates have been lifted. About 113,000 people worked in retail trade in Fort Lauderdale pre-pandemic. As of the BLS’ August report, more than 8,000 such jobs had been recovered since the state re-opened in mid-May, but the sector was still down more than 5,000 jobs from February.

The greater trade employment sector, excluding retail trade, has struggled as well. In addition to the nearly 14,000 retail trade jobs lost in March and April, the market lost an additional 7,000 non-retail trade, transportation, and utilities jobs. By August, the sector was still down more than 5,000 jobs, having recovered less than 30% of losses.

Since South Florida implemented some of the longest lockdowns due to the heightened spread of the virus, the economic recovery here is likely to be slow. Broward County does benefit, however, from a diverse workforce where no one industry accounts for more than 20% of jobs. This should help to insulate Fort Lauderdale from higher losses as a proportion of the workforce during downturns.